Last night, MMGY Global hosted more than 100 travel and tourism professionals and media at our new office in New York, revealing insights from our 2017–2018 Portrait of American Travelers® study. And, while this year’s research indicates a slowdown in intent to travel and a drop in leisure travel spend in the coming months, there are opportunities that marketers can leverage to optimize their efforts in the next 12 months.

View the presentation here.

Millennial Families Driving Growth in Travel

This year’s study predicts that the approximately 60 million traveling households in the U.S. will spend up to a $5 billion decrease on leisure travel in the next 12 months, which is a dip of less than 1 percent from the industry’s eight-year high in 2016. However, the 9.5 million households that are American Millennial families intend to spend 19 percent more on vacations during the next 12 months and intend to travel 36 percent more than the previous year. Compare that to U.S. travelers at large, who only demonstrate a 6-point increase in intent to travel this year

This generational segment is also more likely to travel internationally. A quarter of Millennial family vacations were to international destinations. That creates a substantial opportunity for international travel brands, since only 15 percent of Xers, 10 percent of Boomers and 12 percent of Matures vacationed to international destinations. This is likely related to the group’s world view and optimism, as three-quarters of Millennial families consider themselves happy and optimistic about their own futures (83 percent), not to mention the future of the world (62 percent).

A Shift to Domestic Destinations

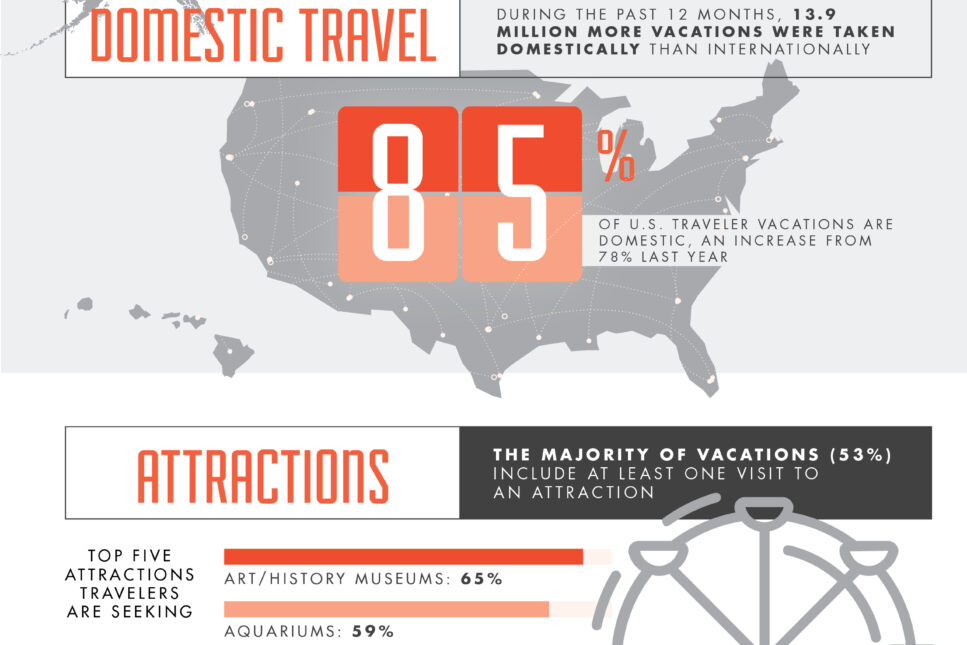

Not all travelers share this optimism, though. By comparison, only two-thirds of all U.S. travelers reported being happy, which represents a drop of 9 points from last year and a five-year low. A similar percentage of travelers are currently optimistic about their future employment, which is a 7-point decrease from last year. This appears to be driving a greater interest in traveling within the states. Domestic vacations now make up 85 percent of American vacations, up 7 points from last year. That means that 13.9 million more vacations were taken within the U.S. compared to outside the country.

Travelers anticipate that 40 percent of their domestic travel this year will be to a new destination, creating opportunity within the U.S. for travel suppliers to influence trial among new guests and visitors. And, those vacations are more likely to be a road trip, as 39 percent of U.S. leisure travel in the last 12 months included a road trip – up 17 points from the year prior.

Attractions Influence Where Travelers Go

As these travelers increase their domestic vacations, attractions are becoming more relevant in influencing where those vacations are taken. More than half of all vacations (53 percent) included at least one visit to an attraction last year. And of those 41.5 million households, 68 percent say that they chose those attractions before their vacations began. This means that travelers are building attractions into their travel planning instead of making the decision while in the destination.

And, with Millennial families on the rise, one might assume that theme parks and amusement parks create the most interest among attractions. However, this year’s research indicates that the top-ranking attractions are more educational and culturally based, with art and history museums (65 percent), aquariums (59 percent) and science museums (56 percent) coming before theme parks (55 percent).

Google Is Growing Its Footprint in Travel

How travelers search and plan for their vacations is shifting as well. Search engines, which were once just pervasive during certain phases of the travel planning process, now lead across the entire purchase. Most significantly, travelers now rank search engine results as their top choice while searching for advice and ratings as well as when they are making reservations (search engines were ranked third in both of those phases the year prior).

This is no doubt due to Google’s investment in travel and release of new travel products in the last two years. In fact, Google is now ranked by U.S. travelers as the site most often used on a regular basis to obtain travel information and prices – a position that has been held by Expedia the last two years.

Invest in Segmentation and Personalization

While all of these insights are important considerations for travel marketers, there are very few travel brands with the reach to make marketing investments and changes based on broad-sweeping trends. Instead, we at MMGY Global recommend investing in tighter segmentation and personalized content, leveraging data and insights across multiple audience clusters to maximize marketing spend.

Last year, we introduced several microsegments that our Portrait of American Travelers® research pointed to as prime targets, and we will do the same in coming months. However, travel brands would be wise to invest in analyzing their first-party data, if they are not already doing so. Comparing these analyses to targeted third-party research will offer specific trends and motivations to build audience clusters. Ultimately, this custom approach to segmentation will drive incremental growth with the proper messaging during this industry slowdown.