It’s easy to follow data trends without interpreting what the data tells us about our customers and their true intent. To assign stereotypes or simple-minded labels to consumer behaviors and demographics that appear to be obvious is where we see travel marketers making mistakes. We are working to dispossess travel marketers of these false assumptions that ultimately lead down a marketing rabbit hole, and thus a missed opportunity to truly understand relevant traveling audiences.

Perhaps an analogy will help paint a picture. For decades, the rate of drowning has followed in lockstep with an increased consumption of ice cream. And when ice cream consumption reduces, so too does drowning. For researchers, the questions raised might include: do people swim too soon after eating or do people grieve drowning deaths by eating ice cream? What cause and effect is important to understand inside the data here?

Well, there is no cause and effect, instead there is another variable: summer. The corollary in the data had nothing to do with cause and effect, instead the truth was masked yet was an obvious factor that wasn’t so obvious.

The analogy illustrates how we look at data about Millennials and other traveling customers with whom we want to connect. If you were to believe the narrative today, you’d think the Millennial cohort is not only singularly unique and monolithic in the way it behaves, but also believe that demand for travel services is being largely driven by 18–34 year olds with very specific and predictable behaviors. The truth is that we do see record travel demand ahead for the U.S. markets, but Millennials represent only a part of that strength.

And more importantly, this quite diverse group behaves in very different ways than what has been widely accepted by marketers. The following are a few facts that underpin what we see outside of the obvious narrative:

- Millennials are now the largest age group in the U.S., but 20 percent make less than $50,000 of HHI, with little impact on the travel industry

- Tendencies, tastes and loyalties vary wildly between the Millennial ages of 18 and 30, as do travel preferences

- Older Millennial families spend at twice the rate of young Millennial travelers, therefore representing a much larger revenue opportunity for most travel brands

- Only 19 million Millennials travel for business (22%)

- While only a small percentage of the 84 million Millennials use brick and mortar travel agents – those that take the most trips use agents frequently (29%)

- Millennials aspire to take exotic trips to Brazil, France and China, but staycations make up the lion’s share of trip type for travelers under the age of 35 (43%)

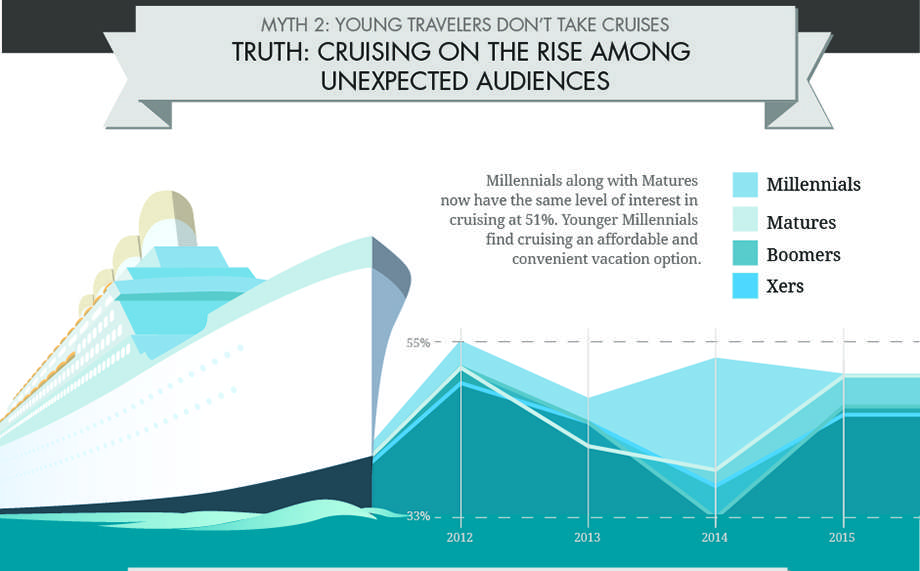

- Millennials and Matures are equally impacting the growth in cruises

- Matures and Gen X generations have the most discretionary time for global travel

In the ‘70s, marketers mistakenly cast the entire younger U.S. population as the “Woodstock” generation, just as today marketers apply terms such as “lazy,” “selfish,” “disloyal” and “overly wired” to Millennials.

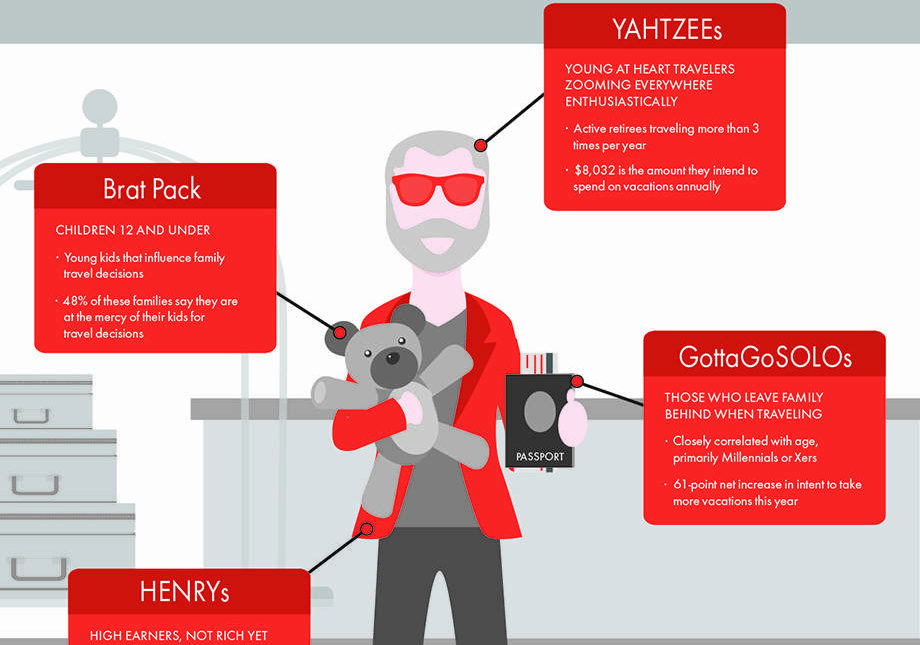

It is no truer today than it was then, that an entire group can be defined in one way. This is why strategic errors are being made in marketing investment and product development based on the grouping of consumers into large buckets versus specific micro-segments that guide product and service refinement. It is absolutely possible today, using reservations, website analytics and sales transactions tied to first- and third-party data sources, to be much more refined in market definition and engagement as well as the way we create product and service concepts. The following are a few examples from MMGY’s profiling team that include not only subsets of the Millennial marketplace, but also key customer groups from Gen X, Boomers and Matures:

While better market definition is the goal, we should concede that there are certain truths and behaviors that can be applied broadly to travelers. In our most recent Portrait of American Travelers®, we learned that there are several facts pervasive amongst all groups that, while not more important than micro-understanding, still inform industry approach:

- Travelers of all ages use travel as personal brand equity on social channels

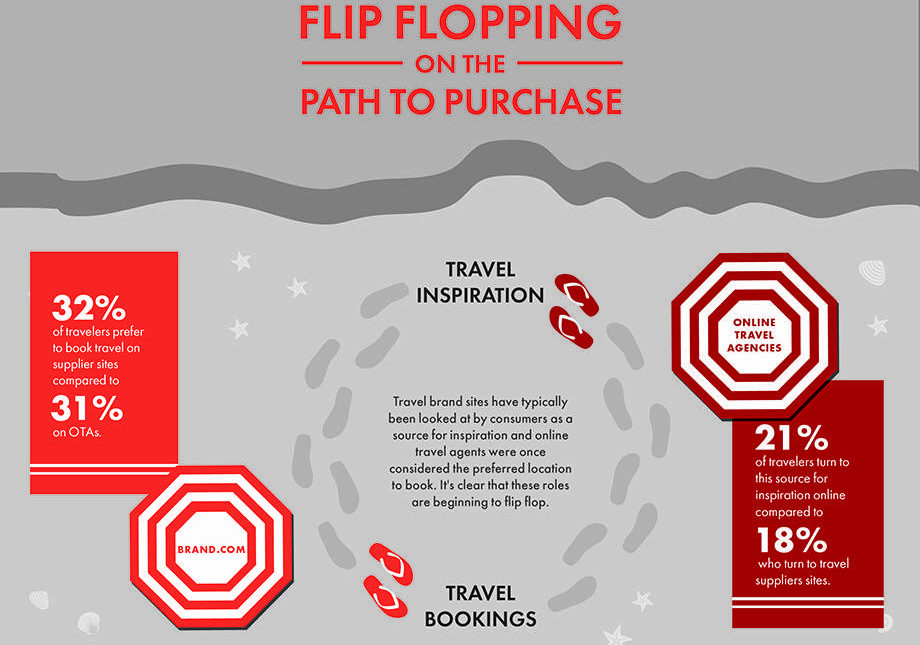

- Prior to booking, travelers’ use of travel websites is on the rise with more time spent online across more types of sites, digital interactions and devices

- OTAs are not being used to book as much as they are now sources for top-of-funnel decision making

- Terrorism and disease are now affecting travel choice and spend

- Augmented reality is not perceived as a valuable travel tool

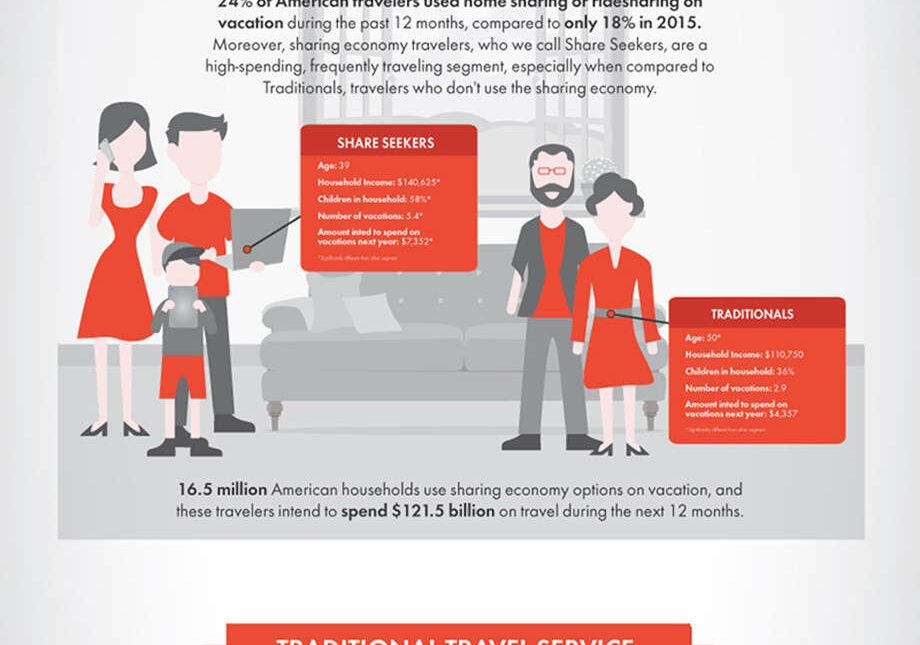

- Shared services is being adopted by all ages and growing faster in non-Millennial segments

While these general trends can be used to understand all travelers, there is much more valuable insight that can be harvested from learning about specific subsets and micro-targets. To avoid being misled by popular trends, conventional wisdom and the trend du jour, you should study your own traveler profiles and match the most valued with your specific business. We have now moved into the era of personalized marketing, and those in our industry that refuse to navigate what is possible with data, do so at their peril.