As the eternal optimist, I have been trying very hard to ignore some of the recent warning signs we have seen in our research as well as in the economic news and revenue forecasts that pervade around the world. One could choose to be optimistic. After all, we have had 100-plus straight months of travel expansion in the United States and there are now parts of the world that are just starting to join the travel revolution, including emerging economies with hundreds of millions of travelers now spending in destinations that have long hoped for the benefits. But despite these positive factors, I see increasing and worrying signs about where worldwide demand is headed and evidence that suggests the U.S. is poised for a slowdown across every travel category. Amongst the concerns:

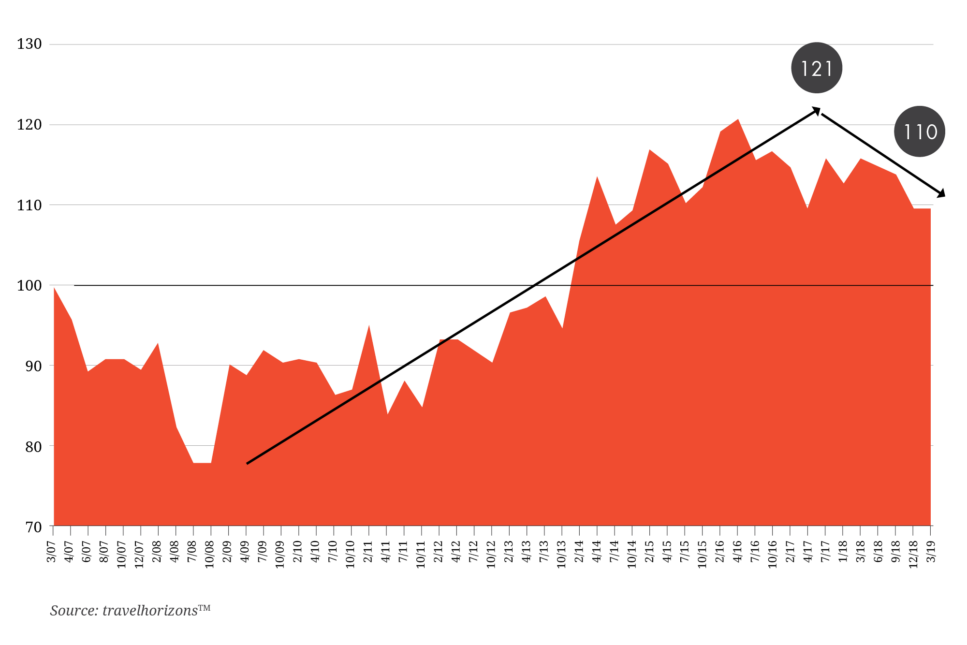

THE MMGY GLOBAL TRAVEL SENTIMENT INDEX (TSI)

As you can see, the TSI represents eight straight quarters of secular decline in our demand index, suggesting that American intent for leisure travel has softened considerably. And this tends to be a harbinger for further demand declines going forward, especially when you dig deeper into our data to see that price sensitivity has jumped significantly over this same period, with 34% of travelers now citing travel costs as the number one concern – versus only 18% in 2016. Another bad sign.

Prices Are Still Rising in Many Cases

In the short term, we see strength in both the U.S. group and corporate transient markets but suspect that those sectors will also begin to decline over the next three quarters. And because commercial demand drop-off is trailing leisure, higher air fares and hotel rates remain in place, creating a further headwind for leisure demand. So, while this could provide some near-term aggregate travel spending increases, RevPAR improvements and airline profits (the latter because airline inventories are at historic lows), by 2020 we expect corporate demand to reverse, followed by pricing and demand erosion across the board. And if international demand in American gateway cities continues to soften, this would not be good for rates in places such as New York City and San Francisco.

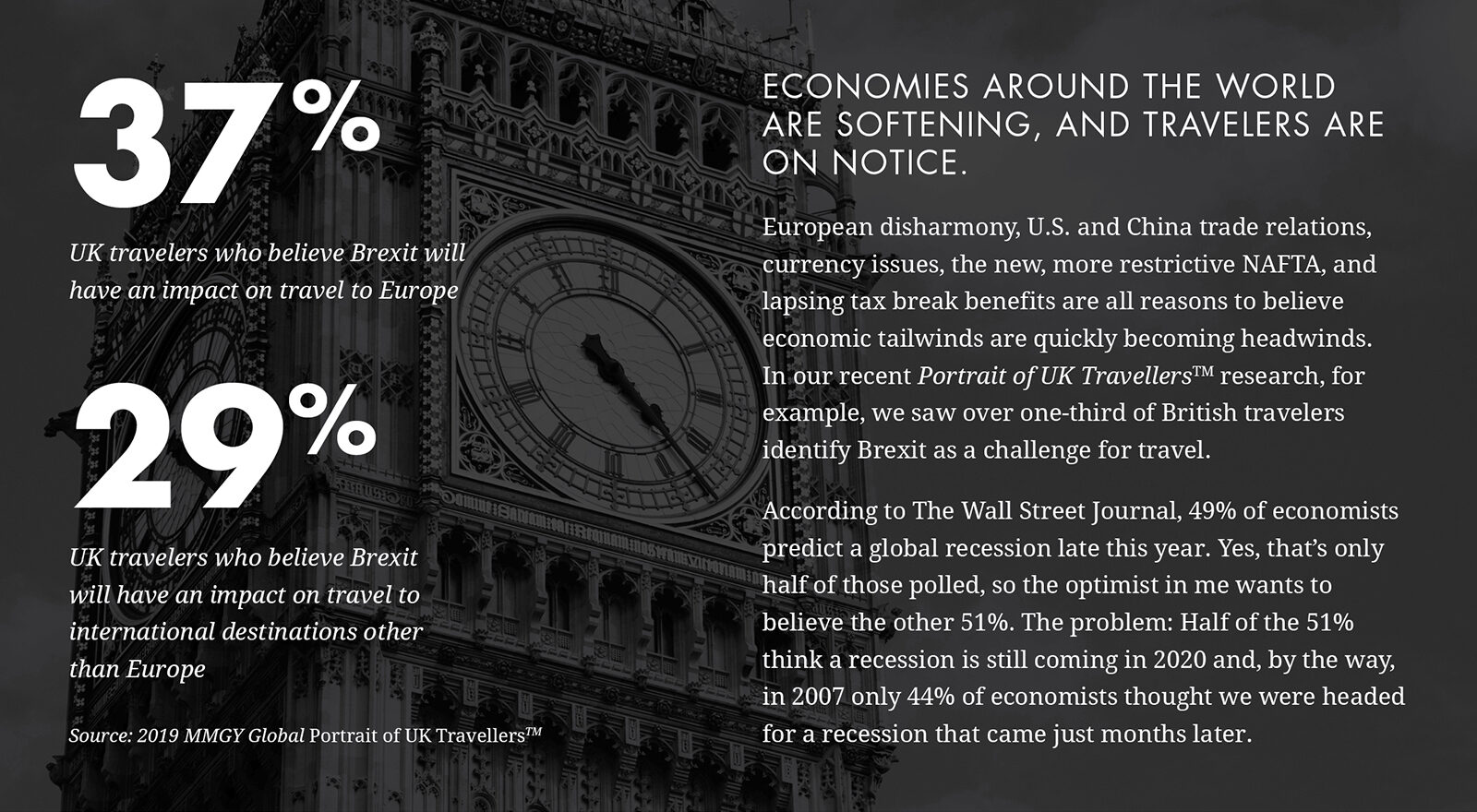

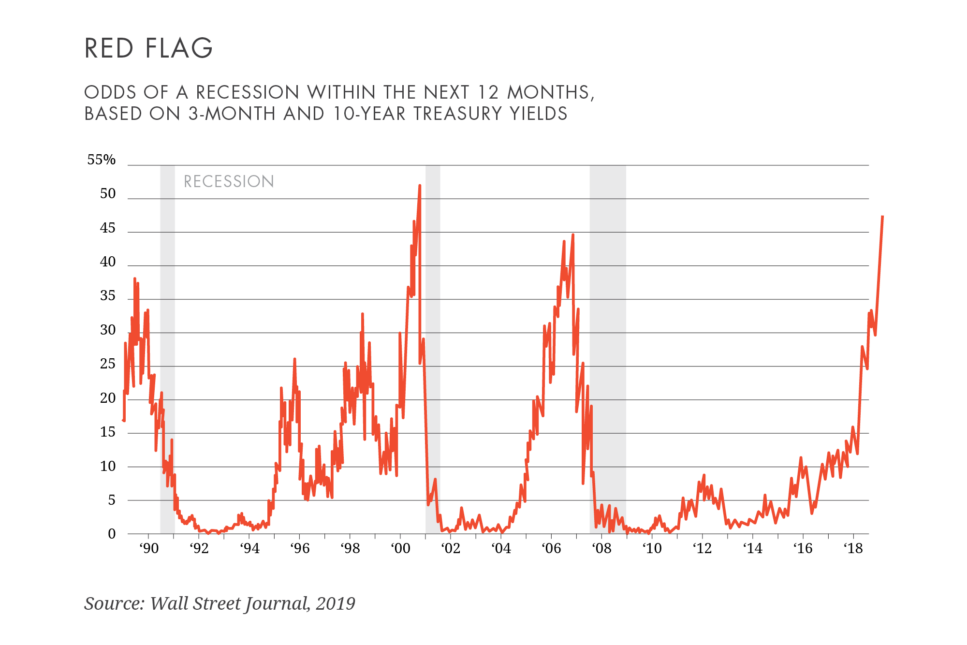

Chance Of a Recession

Our industry also faces ongoing security concerns and a heightened anxiety around travel safety in the world. While the U.S. traveler has proven to be resilient in the face of international terrorism, Zika virus and mass shootings, we know that these events influence travel demand, sometimes in only small ways and sometimes in more fundamental ways, such as has been the case in Egypt, Africa and Central America. As economic conditions worsen and travel becomes less of a priority for global households, we do expect security concerns to further hurt demand for long-haul travel.

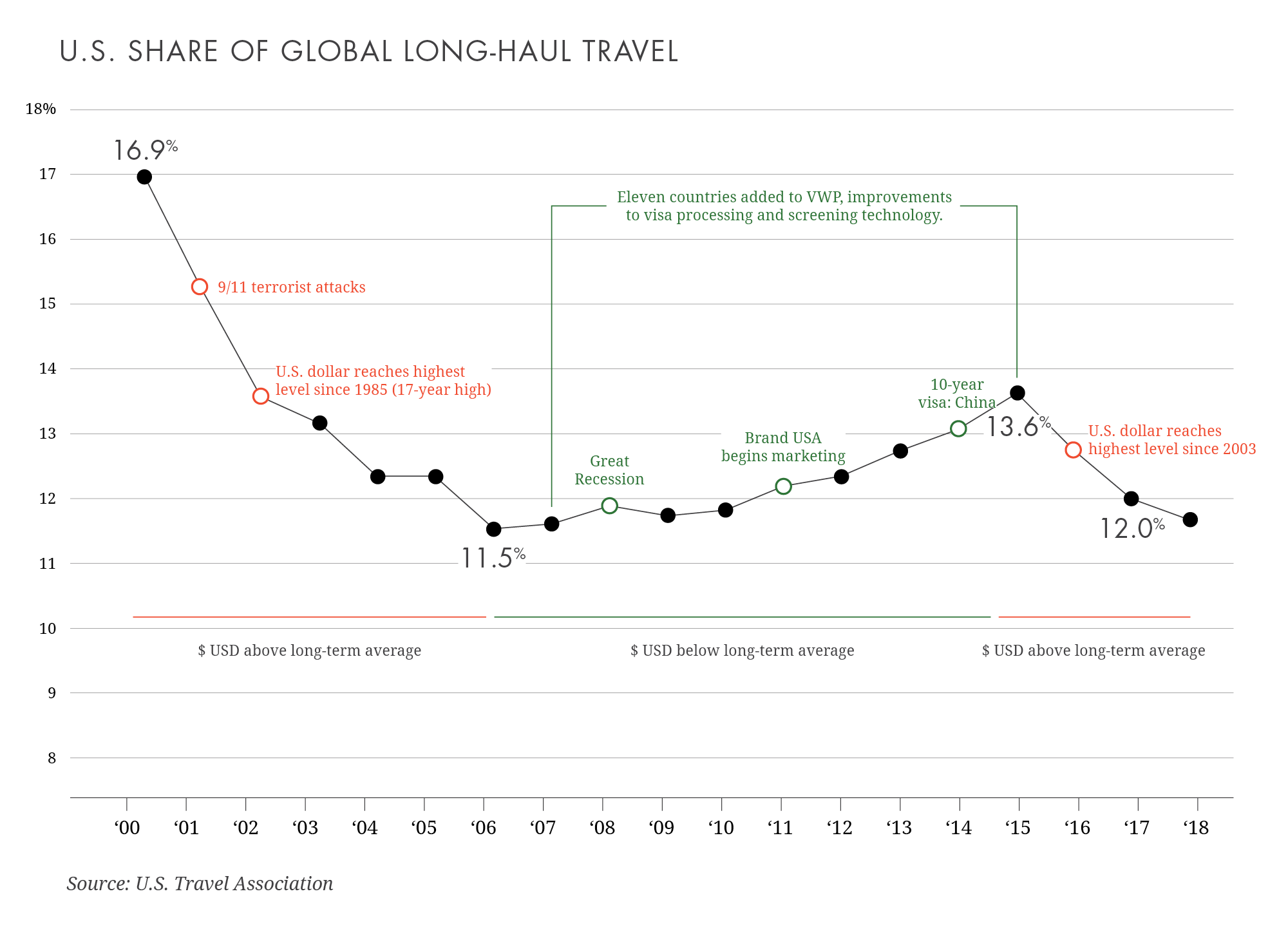

THE BALANCE OF POWER FOR INTERNATIONAL TRAVEL SHARE IS SHIFTING EAST

Although U.S. and European travel economies are still benefiting from inbound international demand, this overall demand as a percentage of global travel has dropped dramatically over the last decade. India and China, as well as emerging economies in EMEA and pan-Asia, are fueling growth in other parts of the world, meaning less proportional demand for traditional destinations as populations change and global airlift chases these new markets. The below chart reflects where U.S. share of international travel has gone since 2000.

It has been interesting to watch the massive investments being made by governments in Dubai, Saudi Arabia and Vietnam to attract more visitors, and this has an effect on the traditional powerhouse destinations in the developed world that stand to lose share if they do not continue to grow airlift, infrastructure and marketing budgets. If you are not aware of the continuing debate on open skies, you should read this from the Centre for Aviation (CAPA). This is but one example of where global competition can also fuel shifts in tourism demand and where private company interests are sometimes at odds with general pro-tourism policy.

WHAT CAN WE EXPECT AS WE MOVE THROUGH 2019 AND INTO 2020?

1. Leisure demand will contract below 2002 levels by early 2020, and corporate demand will follow by Q3, 2020. There is good reason to believe that pockets of the market will remain strong, such as affluent travelers or the Mature age group. In the case of Matures, they do offer some hope for leisure brands with products or packages that cater to tour business, cultural tourism or off-season offerings. In our shop, we talk about the YAHTZEE segment that is a lucrative target. But the problem is that these smaller, niche opportunities (including young solo travelers and government groups) cannot compensate for the larger travel segments – such as middle-class families, small businesses, corporate and association group segments, and long-haul tours – that will contribute less volume to the market over the next two years.

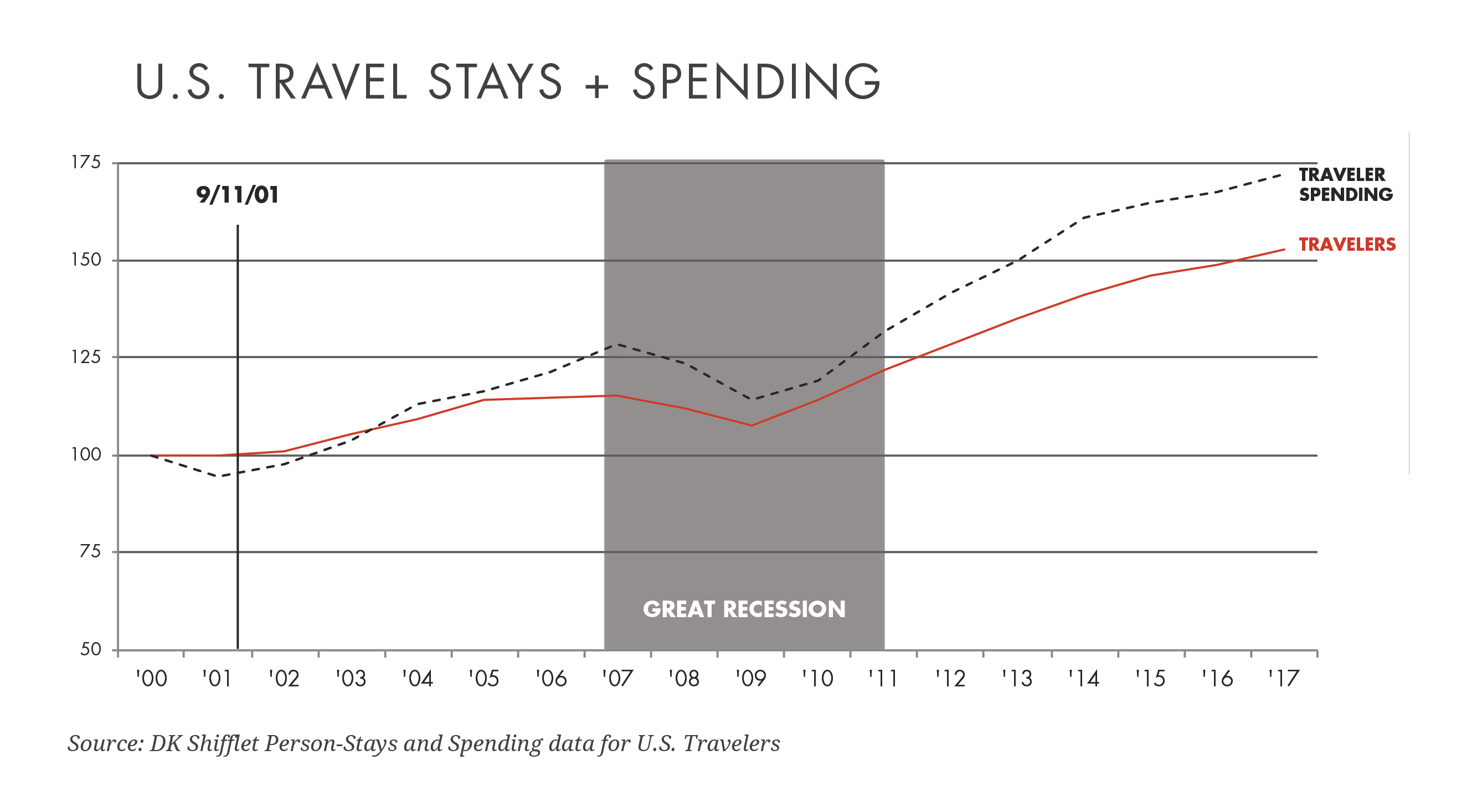

2. As a result, we will likely see what we commonly see in this tougher environment: a drop in fares and rates (i.e., 2008) combined with shorter booking windows, a shift to more frequent trips with lower spend levels, shorter-haul itineraries, as well as a trade-down on product and amenity sets. In 2008, spending declined faster and recovered more slowly than total trips, which also means more domestic travel in-country than trans-Atlantic or trans-Pacific trips. The question is whether we will bounce back quickly, as in 2009, or more slowly as in 2002.

3. It’s possible that the gains brand suppliers have made against third parties will be reversed. Especially in the hotel space, and as demand contracts, we would expect to see less revenue management discipline amongst suppliers. Franchisees and owners in hotels and VRBOs – plus cruise and gaming operators – will be quick to turn to discounted channels, high-cost distribution sources and third-party group aggregators in search of volume. You’d think past recessions would be a cautionary tale, but we doubt it will change anything this time around. And I know it’s easy for me to preach discipline when I don’t own a hotel or a $2 billion ship, all with perishable inventory, but certainly OTAs and other third parties have more to gain in a tight environment. Just as Marriott has negotiated its new Expedia deal and cut meeting planner commissions to 7%, we would expect higher commissions to become more tenable as business is harder to find. We will see how this plays out in air, rental car and attractions, but we would expect even these sectors will rely more on sources such as travel trade or discounted aggregators.

4. Amazon will move into the travel space and completely alter the landscape. I know there is no formal announcement or even tangible evidence that this is happening, but I still call it a certainty. Put another way, Jeff Bezos would be crazy if he does not take advantage of his programmatic data, Prime membership, ability to sell at a discount and potential to curate unique off-the-shelf travel packages at a lower distribution cost to suppliers. Forty-four percent of travelers say they would trust Amazon to build and sell a travel package (a far higher percentage than No. 2 ranked Google), and in that the company has already revolutionized pharmacy, grocery and retail forever, it’s a good bet they will do the same in travel. In a tightening economy, they could also become a better option for both consumers and suppliers looking to connect supply and demand.

WHAT ARE THE OPPORTUNITIES TO GET OUT IN FRONT OF THIS?

1. Invest in pro-growth and tax policy that supports travel. I recently heard Senator Rick Scott speak about how he used travel to buoy a struggling economy as the governor of Florida. It was about investment in travel marketing and infrastructure, with a confidence that travel is a revenue enhancement tool, not a cost to taxpayers. I am hopeful that states and countries will adopt this same mentality. Most importantly, it is crucial that Brand USA and U.S. Travel continue to be fully funded to drive business into the United States travel economy. As Roger Dow of U.S. Travel says, “Travel is trade and travel is commerce.”

2. Use of data will produce winners and losers. Each day there is a reservoir of data points collected about how consumers shop, travel and transact, and the potential is now here to not only understand much more about individuals but to also predict how they will travel in the future. As an increasing number of suppliers and intermediaries chase a reduced market demand, who will win the battle to attach data and machine learning to closed user groups (CUGs) and segments of would-be customers with specific travel needs and who seek relevant product offers? Who is in the best position to provide unique content, rate-appropriate offers and a perfectly timed customer connection that then connects to a simple transaction platform? Our bet: Amazon and Google will be at the top of the food chain in the U.S., and Ctrip, Alibaba and WeChat will be at the top in the Eastern world. In a new environment where data and technology require huge investments, we would suspect this means fewer companies have more consolidated control of the market, not more intermediation by smaller players. Voice and visual recognition combined with personal assistant technology such as Microsoft’s Xiaoice or Google’s Allo have the potential to completely change the way people consume information and to shift loyalty away from consumer brands to loyalty of personalized technology and the decisions made by AI-driven assistance.

3. Invest in brand voice. Although there is evidence that personal technology will begin to process more and more of our decision-making, brand is still important. Before you accuse me of being old-school, hear me out. The truth is that we have reached a level of price parity in most aspects of the travel distribution path, and even where we still have price disparity, strong brands can better overcome the proposition of a third party poaching their supply. Search, meta and CRM platforms have created ubiquity for pricing and product, and giant aggregators such as Booking Holdings have moved to a “we have something for everyone” model. So then how do suppliers win on the margins? We would argue that strong brands shape behavior that not only differentiates beyond price and product, but that good brands also shift share from weaker competitors and protect themselves against the need for deep discounting. Take these stats from ConsumerTech. In our research, consumers tell us they want to attach a narrative to the travel experiences and brands with which they associate. And sometimes that brand narrative can be about price or owning a discount space – after all, that is how Southwest Airlines was born and how it still today trades on that position, even when it is not the discount supplier many believe it to be. Brand as a price position is also fine for operators such as Spirit Airlines or CheapCaribbean.com, but it is most definitely not for many other parts of the market. Storytelling and established brand attributes can mean pricing strength, higher margins, increased loyalty and advocacy for customer retention. With our own global clients, such as Lufthansa or Princess Cruises, we know that investing in brand voice drives business and that a platform combining smart pricing strategy and product merchandising with branded content lifts conversion.

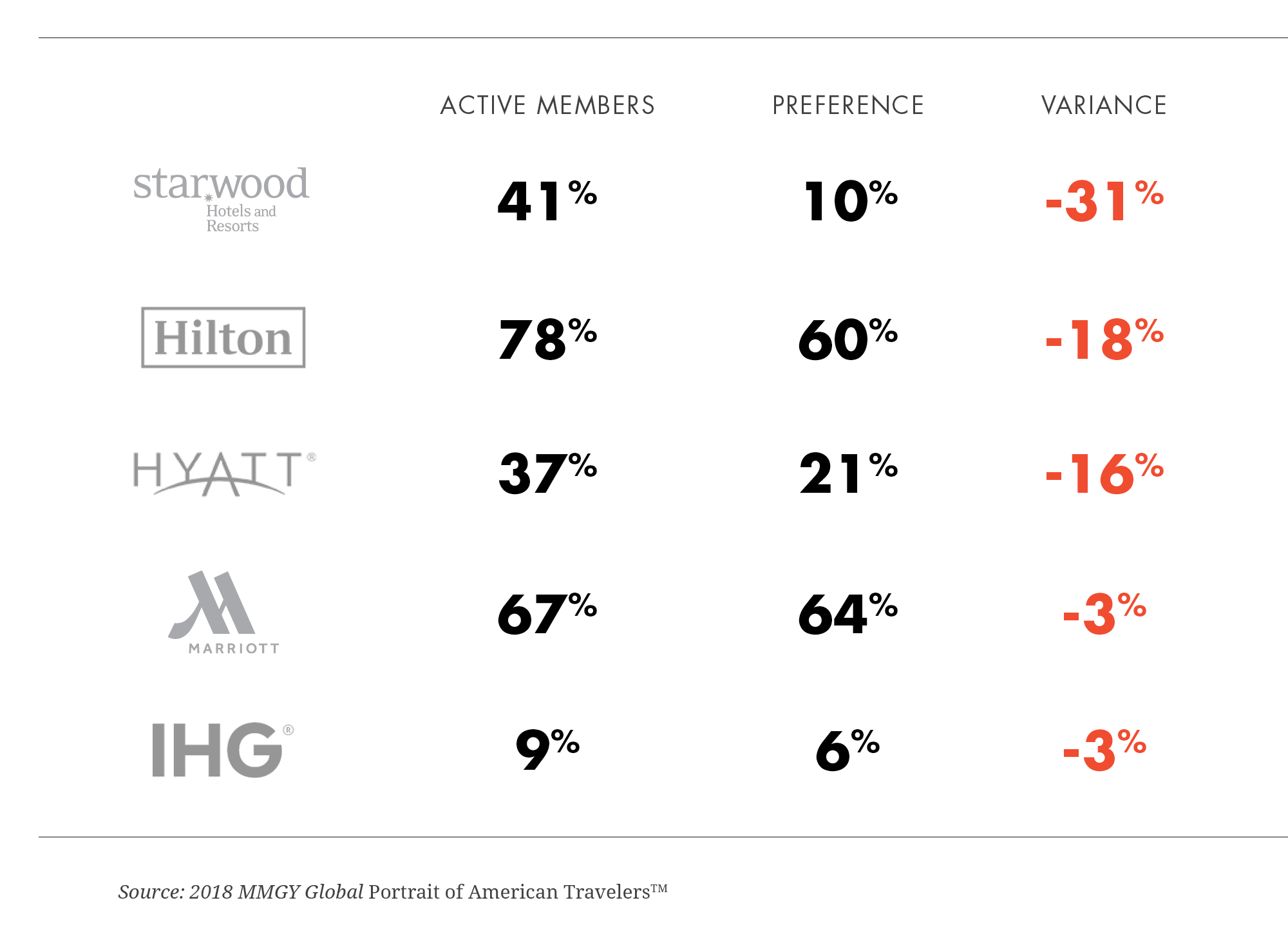

4. Rethink what loyalty means to travelers. Everyone seems to be talking about the recent launch of Marriott’s Bonvoy, mostly on the merits of the name and rollout of the marketing campaign. But I think that misses the point. The real power in the consolidation of Starwood and Marriott is the data and the ways in which Marriott can learn and engage with its guests. The question should be whether Marriott can capitalize on the industry’s largest loyalty base as an enterprise CRM platform. Interestingly, our research shows that travelers are increasingly putting more emphasis on social channel validation than points accrual, and more than three-fourths of airline loyalty members would join a social loyalty program that rewards brand behavior in ways other than points. Twenty-four percent of travelers in our study are making decisions based on social influencer content, and a recent 60 Minutes feature demonstrated how powerful social validation is becoming in shaping purchase behavior. So, can loyalty programs such as Bonvoy close the gap between these factors? It does stand to reason that the traditional approach of signing up anyone and everyone for a travel loyalty program does not fully appreciate the reduced value of points in the decision-making process. Look at the disparity between enrolled members of hotel programs versus active ones. Going forward, it must be more about connecting program membership to brand engagement, valuable and relevant offers, and granular segmentation to build a relevant base of membership. Hotels, attractions, cruise and rental car suppliers are now working on new CRM platforms that address this reality, but many have been slow to connect to other channels such as social, search behavior and mobile proximity. And the OTAs have proven to be much more advanced than the supplier community in developing mobile interfaces that make it easy to shop and transact, proving that a loyalty program, per se, will not carry the day over convenience and accessibility.

5. We are moving away from a reliance on central website platforms to flexible and fast content. The days of suppliers and destinations gathering and curating aggregated information on one massive website platform are quickly coming to an end. Although desktop website behavior still converts traffic and will play a diminished but relevant role for the foreseeable future, the industry must move to more diverse e-commerce ecosystems that take into account mobile, Television commerce (T-commerce) and AR/VR. In Asia, the concept of platform website commerce is almost entirely dead. Consumers there are moving to native apps, social platforms, content engagement in smaller mobile web environments, and third-party shopping bots. The need to invest in enterprise websites is analogous to having a battleship in an air war. Smart travel marketers would be better off standing up content teams, developing major retail alliances and investing in CRM platforms that integrate with social and booking systems. These types of investments should replace the piling up of more central, encyclopedia-like website content that uses as a predicate for success metrics such as “time spent on site.” MMGY Global teams are, instead, working on media approaches that allow shopping and booking to take place entirely outside of the main client website but still within the client booking environment.If China has the right idea (where Ctrip and Fliggy own the market but do so in an environment dominated by social platforms), the direction to go is a recognition that travelers want more content through their own networks and in a way that enables fast, easy access and sharing.

HAVE NO FEAR BUT HAVE A LITTLE BIT OF ANXIETY

It’s not Armageddon. Travel will continue to be one of the most important industries on earth and those who believe a recession will come later, not sooner, could prove correct. ForwardKeys, as an example, just published a report that suggests there is still strength in the UK travel market. And at their annual summit this month, WTTC announced that 2018 was the eighth consecutive year that growth in travel and tourism exceeded global GDP growth.

But growth does not last forever, and we think now is the time to prepare for some tougher times. If history is any indication, a new era of challenges will produce more innovation and more opportunity for the companies that recognize the challenge and get out in front of what is to come. Making sure you have a healthy respect for these coming changes can ensure you face them with your eyes wide open.